The risk quantification is one of the most important analyses in any size company. When we talk about it, we often make the mistake of thinking only in terms of the financial losses or regulatory compliance issuesThe reality is, however, that the risk is much greater. reputational crisis on social networks, a drop in investor confidence or a sudden change in consumer behavior.

What differentiates the companies that survive versus those that stumble is their ability to to accurately measure these threats. It is not enough to detect that a risk exists; it is necessary to put a numerical value on it to decide whether it is worth investing in mitigating it or whether it can be accepted in operations. That is what it means to quantify it, to transform it into figures that guide action and not mere perceptions.

For decades, quantification methods relied on probability tables, impact analysis and statistical simulations.. However, in practice, these approaches were limited in that they could not process large volumes of external data or hard-to-measure intangibles such as reputation or consumer trust. Nowadays, this limitation is disappearing thanks to the use of risk quantification with IA.

The artificial intelligence has opened the door to incorporating unstructured data that were previously left out of models. Opinions in forums, economic news, executive interviews, Twitter mentions or even intonation in a speech can feed models that predict risk scenarios with unprecedented accuracy. This not only gives competitive advantage, it also generates resilience because the company acts before the threat materializes.

A key point is that the risk quantification with artificial intelligence does not replace traditional methods, it enhances them. Where before there was only an estimate based on assumptions, now real signals from the market are added in almost real time. In this way, analysis ceases to be a static snapshot and becomes a dynamic flow of information that evolves with the environment.

Most commonly used methods and models for risk measurement

When talking about risk measurement there is no single valid path. Each sector, each company and even each project needs a methodology that fits its data, its objectives and its level of digital maturity. The interesting thing is that, while there are well-established traditional techniques, more and more companies are incorporating risk quantification with IA to improve their estimates.

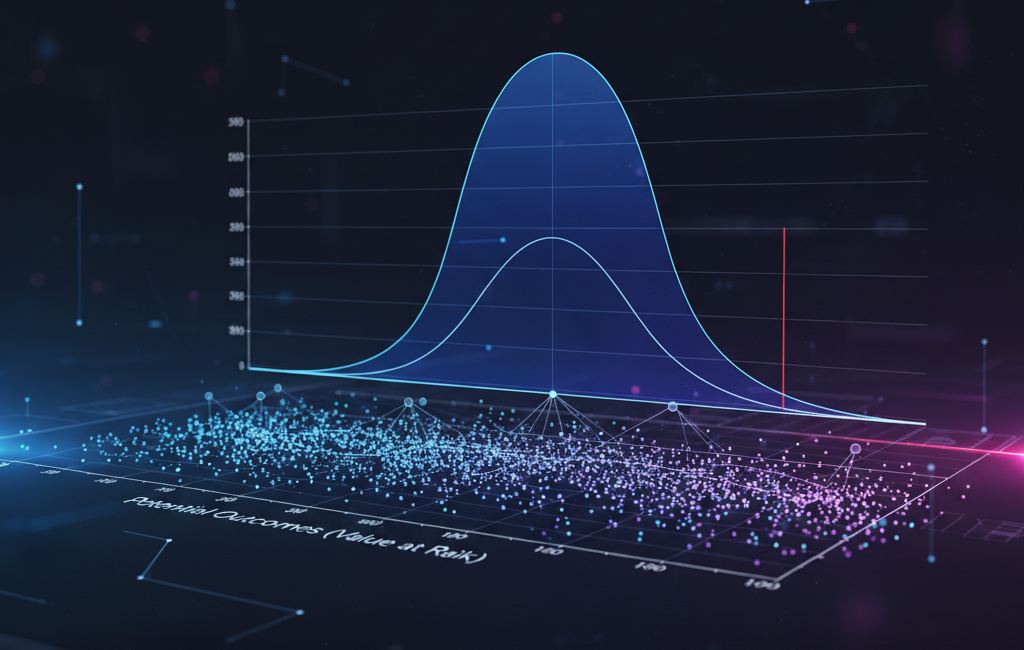

Among the classic approaches is the impact and probability analysis. This method assigns values to the probability of an event occurring and the level of damage it would generate. Combining both dimensions results in a matrix that prioritizes the most critical risks. Another approach is the Monte Carlo simulationwhich makes it possible to model complex scenarios and see how the results change if the input variables are modified. Value at Risk (VaR), very common in finance, is also used, which estimates the maximum loss that can be incurred at a defined confidence level.

These methods, while useful, often fall short in environments where information changes at a dizzying rate. This is where the risk quantification with artificial intelligence. Thanks to machine learning, models can be trained on millions of structured and unstructured data. For example, a system can analyze news headlines and correlate them with stock market movements to predict how a news story will influence market volatility.

Another case study is the use of natural language processing to study sentiment on social networks. If a brand detects that its reputation is starting to deteriorate before it explodes in traditional media, it can react immediately and reduce the impact. In this scenario, quantifying risk is not limited to estimating financial losses, but extends to intangible factors such as reputation, customer trust or social acceptance of a corporate decision.

AI models can also be used to apply unsupervised clustering to discover hidden patterns. For example, identifying customer segments with a high probability of credit default or groups of suppliers more vulnerable to logistical disruptions. In this way, the measurement with AI is no longer a manual and time-consuming task, but an automated process that delivers continuous insights.

What is most interesting is the combination of classic and modern. A company can use Monte Carlo to validate financial scenarios and at the same time incorporate AI-based predictive algorithms that add external signals. This integration offers a holistic and more robust view to make strategic decisions.

Comparison of risk quantification methods

The following is a comparison of methods to know how to perform risk quantification where the evolution and value added by artificial intelligence is shown:

| Method / Approach | Description | Limitations | Contribution of AI |

| Impact and Probability Analysis | Assigns qualitative or semi-quantitative values to the probability of occurrence and impact of a risk, generating a prioritization matrix. | Subjectivity in assigning values; difficulty in integrating unstructured data. | Predictive AI models can estimate probabilities more accurately and consider more variables for impact. |

| Monte Carlo simulation | It models complex scenarios by generating thousands of random iterations to predict the distribution of results and possible losses. | Depends on assumptions and input distributions. Can be slow with massive volumes of data or with highly dynamic variables. | AI can optimize the selection of input distributions, generate more realistic scenarios and process more variables quickly. |

| Value at Risk (VaR) | Estimates the maximum expected loss for a portfolio or project within a given time period and with a given confidence level. | Does not consider "tails" of extreme events (black swans); sensitive to historical volatility; not additive. | Machine learning models can predict VaR more robustly, incorporating real-time market data and non-linear patterns. |

| Sentiment Analysis (IA) | Uses NLP to analyze opinions and emotions in text (social networks, forums, news) and quantify reputational or brand risk. | Does not apply to traditional methods; completely technology dependent. | Early identification of crises, prediction of |

How you manage risk today will determine your success tomorrow. ENIGMIA turns uncertainty into knowledge and knowledge into action.

How artificial intelligence transforms risk quantification

The big change in the risk quantification has come from the hand of artificial intelligence. For years, analysts relied on spreadsheets, limited historical data and tools that provided a partial view of what could happen. Today, with the ability to process large volumes of information in seconds, artificial intelligence has become an essential tool for analysts. risk estimation with artificial intelligence has become an essential pillar in the strategy of many organizations.

The first obvious advantage is the speed. An AI model can analyze millions of financial records, transactions, social media mentions and press articles in a matter of seconds. This allows companies to react long before risk materializes.

The second advantage is the breadth of sources. Not only structured data such as balance sheets or economic indicators are considered. Unstructured data is also integrated: opinions in forums, interviews with executives, audio recordings, YouTube comments or even the intonation in a political speech that can influence the markets. These elements are impossible to handle manually but become accessible thanks to natural language processing and advanced machine learning techniques.

The third advantage is in the predictive capability. Whereas traditional methods focus on describing what has already happened, the risk quantification with artificial intelligence points to what may happen. Predictive models based on neural networks or time series algorithms detect trends, anticipate abrupt changes and warn about the probability of a risk becoming a reality.

A concrete example is seen in the sector banking. Thanks to AI, credit scoring systems can identify customers with a higher probability of default even before signals appear in their credit history. Another example occurs in marketing, where early detection of negative sentiment in networks prevents reputational crises that could cost millions.

Most powerful is the combination of AI and simulations. A predictive model can generate multiple scenarios and quantify the estimated loss under each. In this way, the company not only knows what could happen, but also has a range of probabilities that makes it easier to prioritize resources and design action plans.

The key is that this technology does not eliminate uncertainty, but it does reduce the margin of error. It moves from decisions based on intuition to decisions supported by numerical evidence, enriched with real and updated data. Thus, the risk quantification with IA ceases to be a futuristic concept and becomes a concrete practice that enhances the competitiveness of organizations.

How to implement risk quantification in an enterprise

Talking about risk quantification sounds ambitious, but putting it into practice does not have to be an impossible process. The key is to build a step-by-step path that combines methodology, data and corporate culture. When structured well, the risk quantification with IA becomes a strategic asset rather than a technical burden.

The first step consists of clearly define the objective. Quantifying financial risk in an investment portfolio is not the same as calculating reputational risk in a marketing campaign. Each scenario requires specific variables and different ways of measuring impact and probability.

The second step is the data collection. Artificial intelligence makes a difference here, because it is not limited to accounting information or internal reports. It can also capture data from social networks, open surveys, newspaper articles and public documents. This mix of structured and unstructured data is what brings depth to the model.

The third step is the cleaning and preparation. Not all data are useful as they arrive. There is noise, duplicates and biases that distort the results. For this reason, standardization, labeling and validation techniques should be applied to ensure consistency.

The fourth step is the modeling. Both traditional and modern approaches come into play here. A Monte Carlo analysis can coexist with a machine learning model trained to identify hidden correlations. The important thing is not to choose a single path, but to integrate tools to enhance accuracy.

The fifth step is the validation. A risk model should not be accepted blindly. It is necessary to test it with historical data, compare it with actual results and adjust parameters until a high level of reliability is achieved. The risk quantification with artificial intelligence gains value only when models prove to be consistent in different contexts.

The sixth step is the day-to-day implementation. It is not enough to have a static report. The results must be integrated into dashboards that are regularly consulted by the management team. In this way, the information flows and becomes a decision-making tool instead of being stored in a document.

Finally, there is the part of the corporate culture. The best technology loses strength if there is no confidence in it. Training teams, showing success stories and explaining how metrics are generated are necessary actions for the organization to truly adopt this practice.

A useful checklist includes target definition, source identification, ingestion pipeline, model selection, evaluation metrics, deployment and monitoring. By following these steps, the company not only obtains better decisions, but also gains resilience to unexpected changes.

The future of risk quantification is in AI

All indications are that the risk quantification will continue to evolve into a hybrid model where traditional approaches coexist with emerging technologies. Classic frameworks offer stability, but the speed and complexity of today's world require the addition of new tools. This is where the risk quantification with IA gains prominence and becomes a competitive advantage.

The financial, insurance, logistics and marketing industries are already leveraging artificial intelligence to detect early signals, anticipate crises and reduce exposure to loss. Organizations that do not integrate these models will be a step behind those that do. The risk quantification with artificial intelligence is not a fad, it is a strategic necessity in an environment marked by constant uncertainty.

However, applying sophisticated algorithms is not enough. The real difference lies in using AI to capture what seemed impossible before: intangibles. Reputation, brand trust, message veracity or the impact of a sponsorship are factors that have a decisive influence on the value of a company. Putting a number on them and managing them as rigorously as a balance sheet is what distinguishes leading companies.

ENIGMIA the smartest way to quantify risks

ENIGMIA is a company of Artificial Intelligence and Big Data with a clear mission to revolutionize the way communication, marketing, sales and investment professionals evaluate intangibles through the analysis of unstructured data.

We create solutions that respond to specific corporate challenges: reputation measurement, brand valuation and sponsorships, risk quantificationThe selection of characters based on values and personality, analysis of tone of voice and feeling, as well as evaluation of truthfulness in content.

Our team combines profiles in communications, public affairs, marketing, advertising and technology. Together we transform complex questions into objective, data-driven answers for organizations to make confident decisions.

If your company is looking for an innovative approach to risk quantification with IAin ENIGMIA we can help you.

- Schedule a demo and find out how we integrate unstructured data into risk models

- Explore case studies on reputation, investment and communication.

- Receive an implementation plan with clear milestones and estimated ROI